It’s got a hefty learning curve for the average user, but the efforts pay off with full oversight into all your money.It’s affordable for what it provides, and if you pay upfront for 12 months, there is a 25% discount.You can cancel at any time (or change your plan).Forecasting your budget/a cash flow is the key to financial security and freedom.If you have a paid account, all transactions are updated automatically via bank feeds from NZ banks.Has a safe-to-spend feature so you always know how much you can spend without going over your budget.If you want auto synching and to forecast your cash flow for 10 years to truly achieve FIRE, the paid plans start at NZ$9.95/month.

#Personal budget app free#

Know this: PocketSmith is free if you manually input your transactions and want to project your cash flow for 6 months ahead. Pocketsmith offers the tools to make this easier, by allowing you to forecast a budget to help achieve your goals If FIRE (financially independent, retire early) is on your radar, you must master this skill. PocketSmith offers the ability to forecast your cash flow. Whether you have two jobs or a day job and a few side gigs, track all your income in one place with PocketSmith. Most budgeting apps don’t accommodate more than one income PocketSmith does.

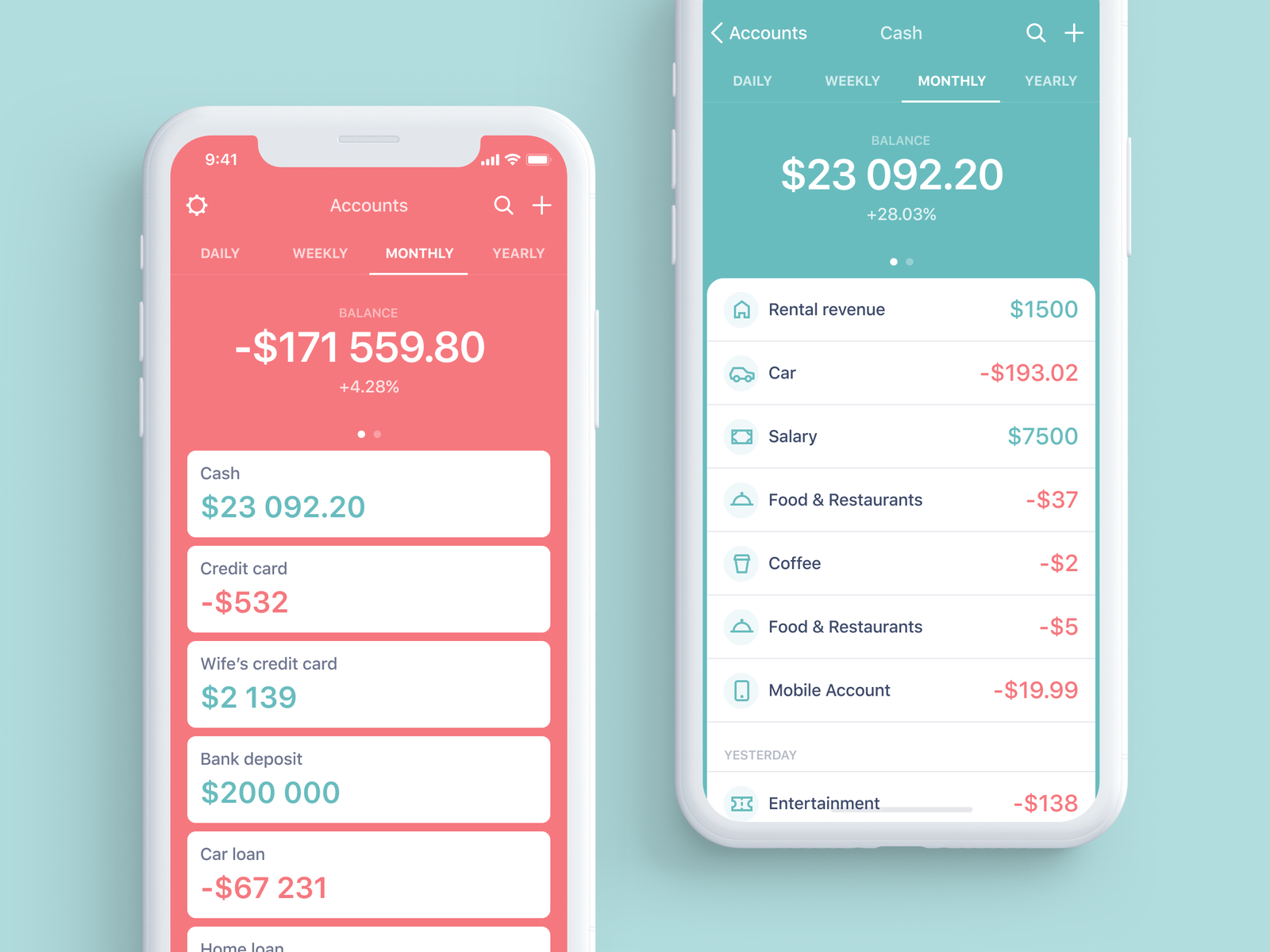

See your spending in categories, making it easier to determine where you need to cut back.NZD) and updates it according to current exchange rates Works across all devices including phones, tablets, and PCs.Get the big-spending picture all at once.No - you'll need to upload transactions manually. Easily see where you stand with any of your goals, make adjustments as needed, and even scan your receipts for safekeeping.

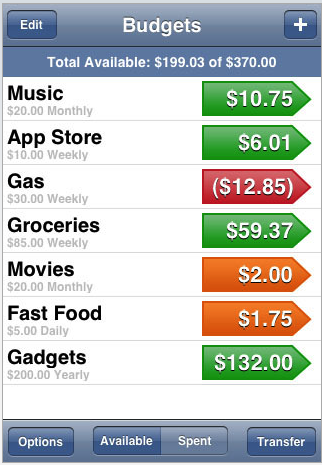

You can set up a savings plan/goal, as well as a debt and loan repayment plan. You don’t have to worry about re-entering recurring transactions, and in fact, it sends you reminders of your recurring bill due dates so you can say goodbye to late fees or credit card interest. With a free app, it offers an interface that is user-friendly, making it easy for anyone to enter transactions in just a few seconds. Money Lover sets out to make budgeting simple. Website: Booster mybudgetpal App (online only, not available on the Apple App Store or Google Play) The helpful FAQs explain that your data is safe and secure. It's not an app as you access it via a secure website.You don't need to be a Booster customer to use it.A budgeting module lets you schedule upcoming bills and payment due dates to get motivated.Spending limits help change behaviours.This means you can have a single view on where you're spending your money. mybudgetpal syncs with your bank accounts every day and automatically sorts your transactions into expense categories.Spending limits are a feature (meaning you can save more and incur less unnecessary expenses by seeing where your money goes)ĭoes it sync automatically with New Zealand bank accounts?.mybudgetpal gives you a complete view of your finances it tracks your spending so you can compare spending over different periods and isolate areas or habits that need attention.Additionally, you don't need to be a member of the Booster KiwiSaver Scheme. In a nutshell, Booster's mybudgetpal is a program that that synchs with your bank account and is free to use.

0 kommentar(er)

0 kommentar(er)